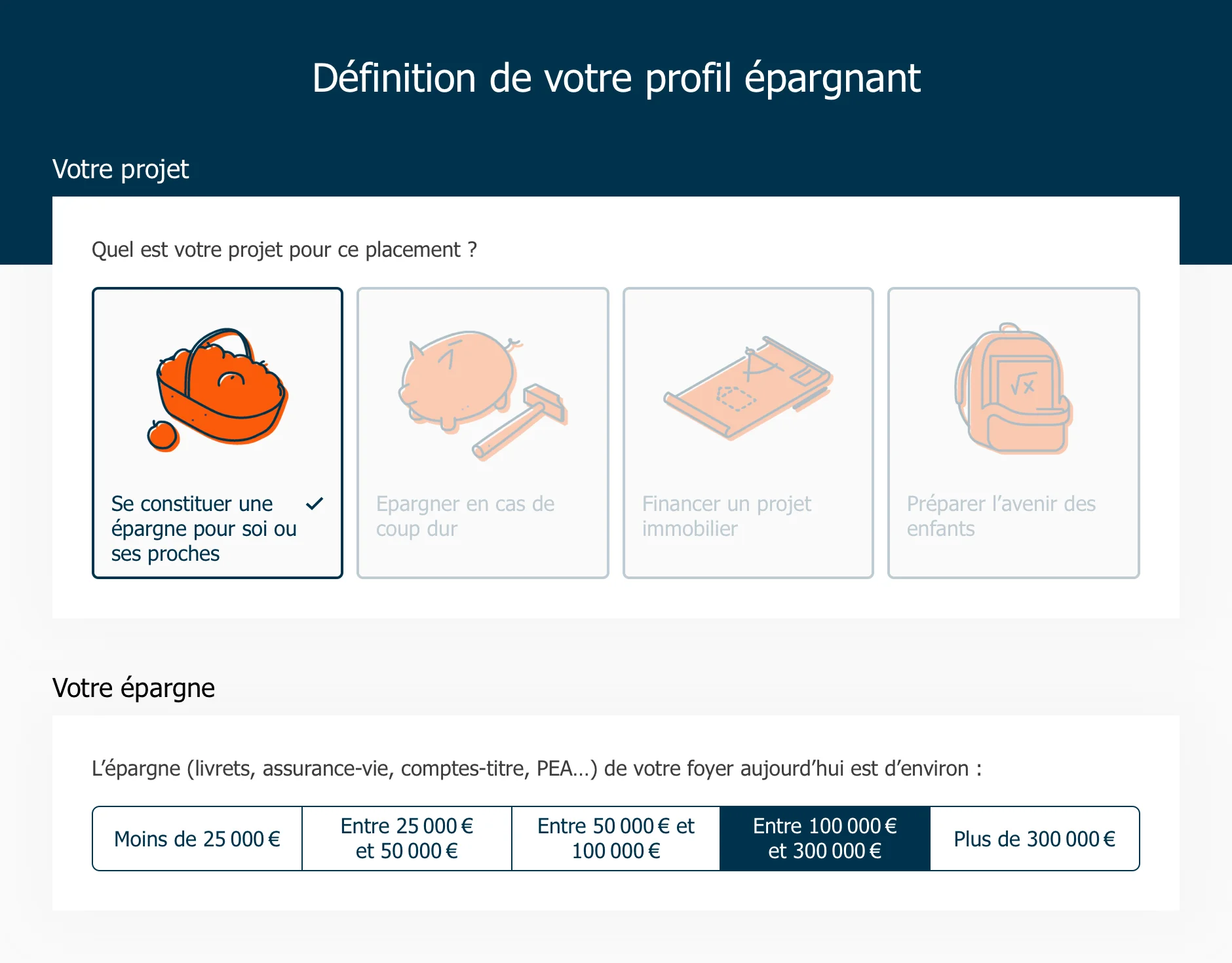

Completely online

Accessible for all types of structures.

Easily set up.

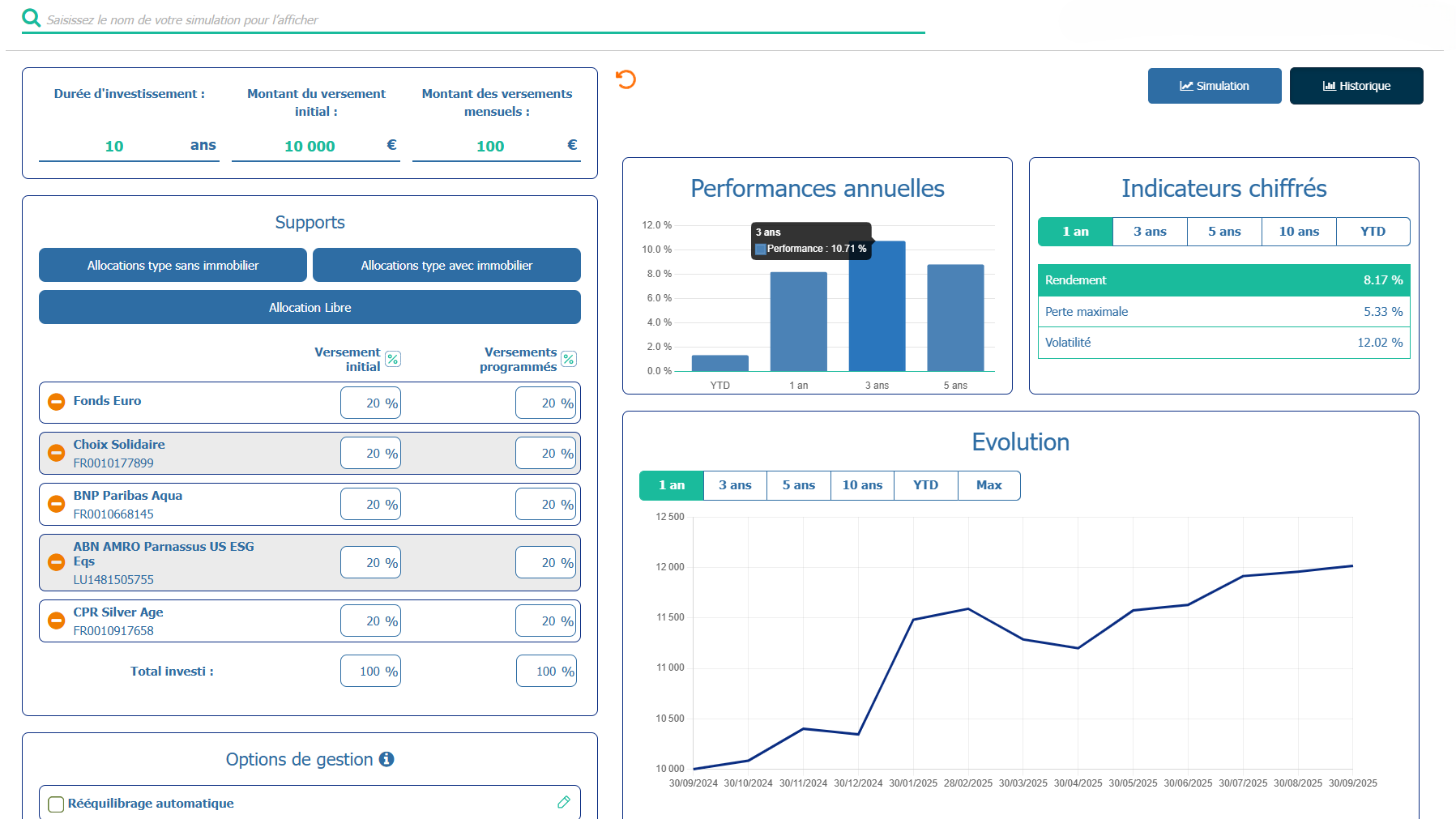

Fully automatizable

By using Fundvisory's robot-advisor bricks.

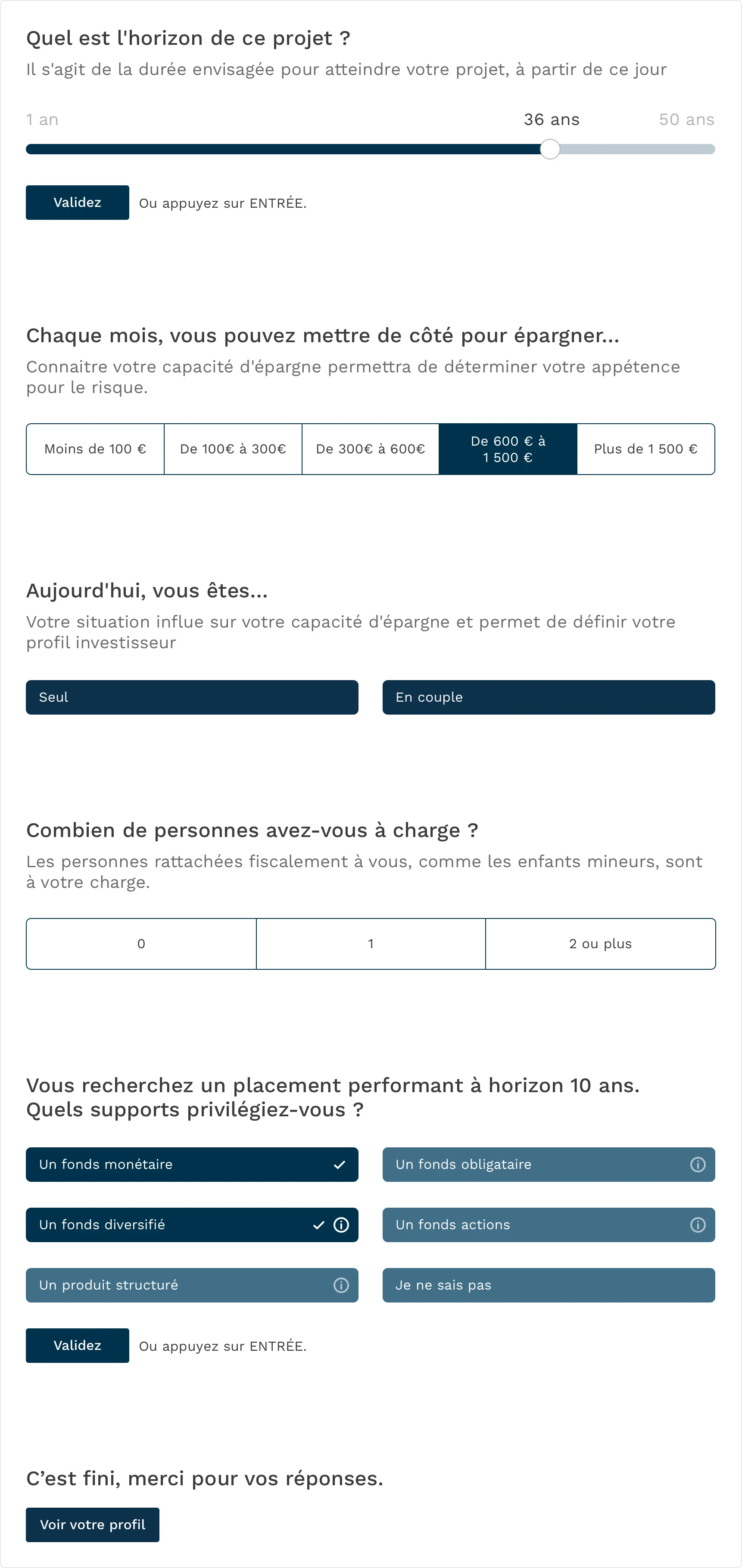

Comply with regulations

On the adequacy of the profile-advice-product and the traceability of the advice.

Shorten the duration of customer journey

By 75% thanks to the efficiency and automation of the Fundvisory modules.

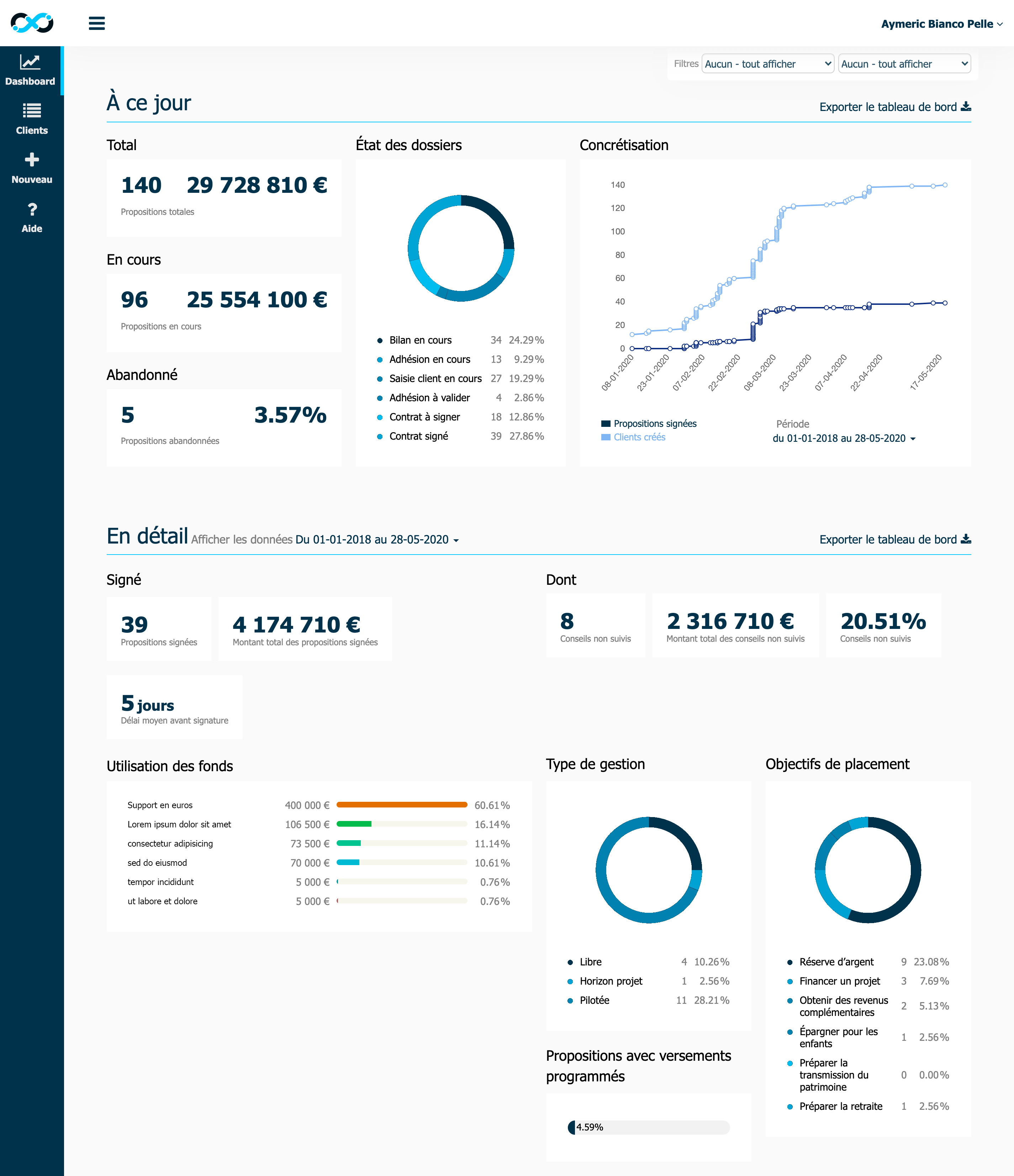

Increases profitability

Of the broker or advisor by a factor of 4.

Significantly reduce risks

Regulatory and operational risk.